President-elect Donald Trump has escalated his rhetoric against the BRICS bloc—Brazil, Russia, India, China, and South Africa—by threatening to impose a 100% tariff on goods from member countries if they pursue plans to create a new currency. His remarks, made on Truth Social, signal an aggressive stance to counter any challenge to the U.S. dollar’s dominance in global trade and finance.

Trump’s Demand: Halt Currency Creation or Face Consequences

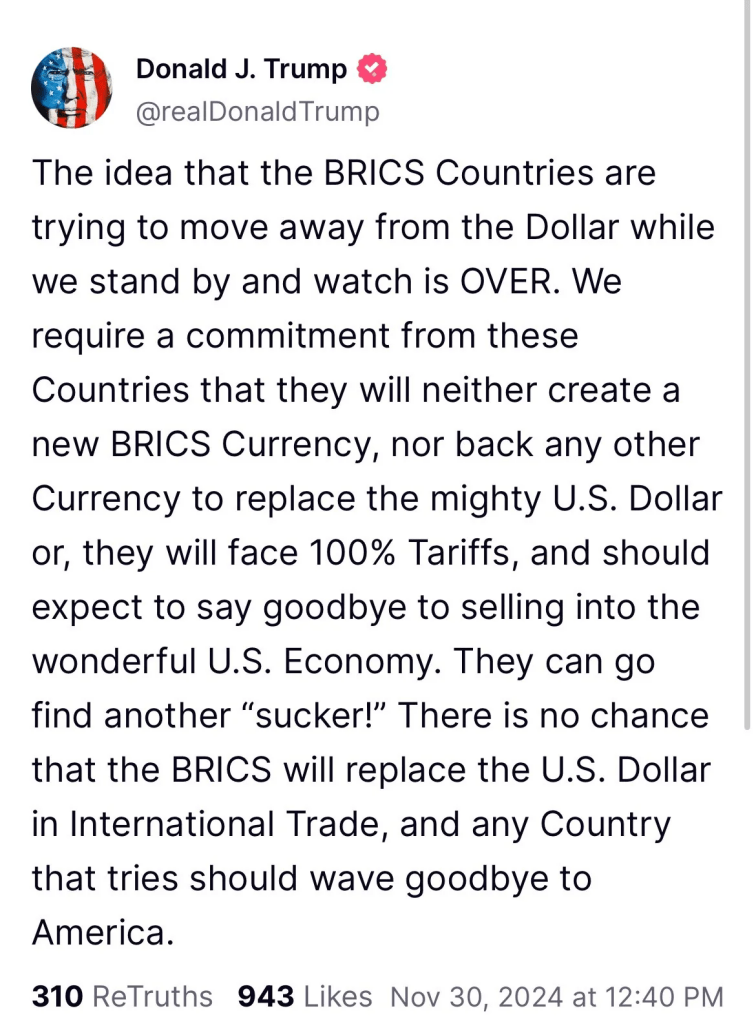

Trump’s post on Truth Social left no ambiguity: “The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER. We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. Dollar, or they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful U.S. Economy.”

The former president’s demand seeks to maintain the dollar’s hegemony as the world’s reserve currency. The proposed BRICS currency, potentially backed by gold or other commodities, poses a direct threat to the economic advantages the U.S. derives from dollar dominance.

The Expanded BRICS Bloc: A Growing Challenge

Since 2011, the BRICS bloc has included Brazil, Russia, India, China, and South Africa. In 2023, the alliance expanded to incorporate Iran, the United Arab Emirates, Ethiopia, and Egypt, marking its first expansion in over a decade. According to South African Foreign Minister Naledi Pandor, 34 additional countries have expressed interest in joining the group.

While the group remains economically diverse, the idea of reducing reliance on the U.S. dollar resonates strongly among members. In 2023, Brazilian President Luiz Inácio Lula da Silva proposed a common currency for South America to ease dependence on the dollar.

Additionally, China and Russia view BRICS as an opportunity to strengthen their partnerships and challenge Western-dominated financial systems. Utilizing BRICS-based currencies and non-dollar-denominated banking systems could also allow countries like Iran and Russia to circumvent U.S.-led sanctions.

Skepticism Within the Bloc

Despite its ambitions, the BRICS bloc faces significant internal challenges. Ahead of the October 2023 BRICS summit in Russia, President Vladimir Putin downplayed the possibility of a common BRICS currency, stating, “Its time has not come yet. We need to be very careful and act gradually, without any rush.”

Putin emphasized enhancing the use of national currencies and coordinating central bank policies as interim steps to facilitate trade. The diverse economic priorities and geopolitical differences among BRICS members also make the creation of a unified currency a complex undertaking.

Geopolitical Ramifications

Trump’s tariff threat comes amid a broader geopolitical power struggle. During the October BRICS summit, leaders like Putin and Chinese President Xi Jinping portrayed the West as increasingly isolated, contrasting this with what they called a “global majority” aligning against U.S. dominance.

For China, the expansion and strengthening of BRICS align with its strategy to forge alliances that challenge Western economic and political influence. For Russia, the bloc offers a crucial platform for economic and diplomatic engagement, particularly as Western sanctions continue to bite following its invasion of Ukraine.

Trump’s Tariff Playbook

Trump’s threat against BRICS is not an isolated incident. Recently, he announced plans to impose tariffs on imports from Mexico, Canada, and China, citing issues such as illegal immigration and drug trafficking. These moves reflect his broader protectionist economic policy and willingness to use tariffs as leverage in foreign policy.

Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum have engaged with Trump in the wake of these announcements, seeking clarity and compromise. However, the former president’s hardline approach signals that economic nationalism will be a defining feature of his administration.

Trump’s threat of 100% tariffs on BRICS nations underscores the mounting tension between the U.S. and the bloc of emerging economies. While the likelihood of a unified BRICS currency remains uncertain, the mere prospect has prompted significant reactions from U.S. policymakers, reflecting the dollar’s central role in American economic power.

As BRICS nations continue to explore alternatives to the dollar, the global financial order faces growing uncertainty. Trump’s approach, combining tariffs and hardline rhetoric, seeks to deter such shifts but may risk alienating allies and trading partners in the process.